2025: Your Pension Is Rising! Practical Steps to Maximize Your Retirement Income

As we approach 2025, many retirees and future retirees in the U.S. are looking for ways to maximize their pensions and retirement income.With various policies, adjustments, and strategies available, increasing your pension requires understanding the key factors affecting your benefits, as well as taking action now. This article offers practical steps you can take, based on authoritative data and future expectations, to help you secure a more comfortable retirement.

Step 1: Maximize Social Security Benefits

Social Security remains the cornerstone of many Americans' retirement income, with more than 70 million people relying on it as their primary source of income. The good news is that Social Security benefits are expected to increase in 2025, thanks to the Cost-of-Living Adjustment (COLA), which adjusts benefits based on inflation.

How to maximize your Social Security benefits:

1.Delay Your Claims for Higher Benefits: Social Security benefits increase by approximately 8% each year for those who delay claiming after their full retirement age (FRA). For instance, if you were to delay your benefits until age 70 instead of claiming at 66, you could receive an additional $1,000 or more per month, depending on your earnings record.

Example: Jane, a 66-year-old retiree, chooses to delay her benefits until age 70. By doing so, she increases her monthly Social Security check from $2,000 to $2,700, resulting in an extra $700 each month—$8,400 annually.

2.Work Longer to Improve Your Earnings Record: The Social Security Administration calculates your benefits based on your highest 35 years of earnings. If you have fewer than 35 years of earnings, it will average in zeroes, lowering your benefit. By continuing to work in your later years or boosting your income, you can raise your benefit amount.

Example: John, a worker who has 32 years of earnings, continues working until age 70, boosting his earnings for the final years. This increases his benefit by $600 per month, a significant improvement over the course of his retirement

3.Use Online Tools for Planning: The Social Security Administration offers several tools, including the Retirement Estimator, which helps you calculate how delaying your benefits or increasing your earnings will impact your Social Security amount.

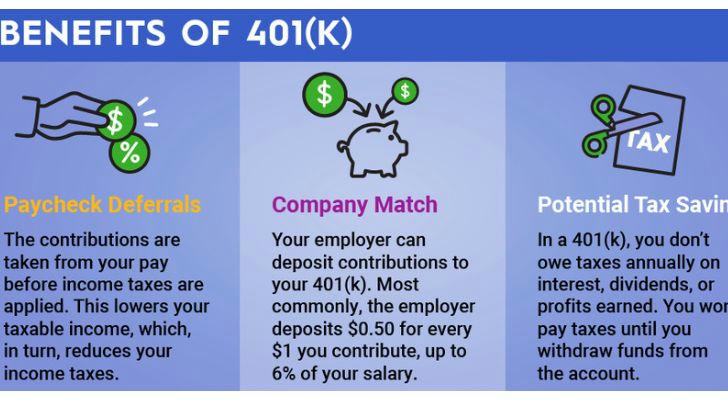

Step 2: Contribute More to Your 401(k) and Employer-Sponsored Plans

If you’re still employed, increasing your contributions to a 401(k) or other employer-sponsored plan can be one of the best ways to increase your pension and grow your retirement income. The U.S. tax system incentivizes these contributions by deferring taxes until retirement, which helps to increase your savings.

How to maximize your 401(k) contributions:

1.Max Out Your Contributions: In 2025, the IRS will allow you to contribute up to $22,500 to your 401(k), with an additional $7,500 if you're 50 or older, bringing the total to $30,000. This extra contribution significantly boosts your savings.

Example: Maria, aged 55, contributes the maximum amount to her 401(k), including the catch-up contribution. She increases her retirement savings by $30,000 in just one year, significantly improving her long-term retirement income.

2.Take Full Advantage of Employer Matching: Many employers offer a matching contribution, where they match a percentage of your own contributions. This is essentially free money that helps to grow your pension more quickly.

Example: Robert works for a company that offers a 5% match on his salary. He earns $60,000 a year, so by contributing 5% of his salary, Robert gets an additional $3,000 from his employer every year.

3.Consider a Roth 401(k): If your employer offers a Roth 401(k), you can contribute post-tax dollars now, but your withdrawals in retirement will be tax-free. This can be a powerful strategy if you expect to be in a higher tax bracket when you retire.

Step 3: Invest in Individual Retirement Accounts (IRAs)

In addition to employer-sponsored plans, an IRA offers a great way to increase your pension. Whether you choose a Traditional IRA (tax-deferred) or a Roth IRA (tax-free withdrawals), IRAs offer flexibility and significant tax advantages.

How to maximize your IRA contributions:

1.Contribute to Your IRA Regularly: The contribution limit for IRAs in 2025 will be $6,500 for those under 50, with an additional $1,000 for those over 50 (catch-up contributions). Contributing the maximum amount each year can significantly boost your retirement savings.

Example: Emily, aged 48, contributes $6,500 annually to her IRA, and with compound interest over 20 years, her total contributions of $130,000 grow to nearly $300,000 by retirement.

2.Consider a Backdoor Roth IRA: If your income exceeds the limits for Roth IRA contributions, you can still contribute by using the backdoor Roth IRA strategy, which involves contributing to a Traditional IRA and then converting those funds to a Roth IRA. This allows high earners to access the benefits of tax-free withdrawals in retirement.

3.Diversify Your Investments: Whether you choose a Traditional IRA or a Roth IRA, ensure that you diversify your portfolio. A mix of stocks, bonds, and real estate investment trusts (REITs) can provide growth and stability over time.

Step 4: Invest in Real Estate and Alternative Assets

Real estate and other alternative assets can be powerful tools for increasing your retirement income. While they come with higher risk, these investments can offer higher returns compared to traditional stocks and bonds.

How to diversify your portfolio with real estate:

1.Invest in Rental Properties: Owning rental properties can provide a steady stream of income in retirement. The average annual return on rental properties is around 8%, which can significantly enhance your pension.

Example: David invests in two rental properties over the course of his career. By the time he retires, these properties generate an extra $2,000 per month, helping to supplement his pension and Social Security benefits.

2.Explore Real Estate Investment Trusts (REITs): REITs allow you to invest in real estate without buying physical properties. REITs offer a way to earn passive income from commercial and residential properties, typically paying out high dividends.

3.Consider Cryptocurrencies and Altcoins: While riskier, investing a small portion of your retirement savings in cryptocurrencies and altcoins can provide substantial returns, particularly in a rapidly evolving market. However, only invest money you can afford to lose.

Step 5: Work with a Pension Advisor

A pension advisor can help you navigate complex pension plans, tax strategies, and investment options to maximize your retirement income.

How a pension advisor can help:

1.Review Your Pension Plan: Advisors can help you understand your options with employer pensions, Social Security, and other retirement savings plans. They can suggest strategies for increasing your monthly benefits and reducing taxes.

2.Create a Comprehensive Retirement Strategy: Advisors help integrate all aspects of your retirement income, including Social Security, 401(k) withdrawals, and IRA distributions, ensuring that your income lasts through retirement.

3.Optimize Tax Planning: Your advisor can help you minimize taxes on withdrawals and maximize tax-deferred growth by advising on the timing and methods for withdrawing from different retirement accounts.

Conclusion: Take Action Now to Increase Your Pension in 2025

The year 2025 presents significant opportunities to increase your pension and retirement income, thanks to adjustments in Social Security benefits, tax incentives for retirement savings, and a variety of investment options. By taking steps now—whether through delaying Social Security benefits, maximizing your 401(k), contributing to an IRA, or investing in real estate—you can ensure a more secure and prosperous retirement.

With the right strategy in place, including working with a pension advisor, you can take full advantage of the available policies and tools to boost your pension and retire comfortably.