Start Saving at 30: 3 Investment Strategies for a Secure Retirement

When it comes to retirement savings, many people tend to view it as a distant issue, especially for those in their 30s. At this stage, you might be busy with career development, family life, and other daily tasks, leaving little time to think about how to build a solid foundation for your retirement. However, banking investment experts remind you that the earlier you start saving and investing, the more wealth you can accumulate through the power of compound interest, ensuring financial freedom and a comfortable lifestyle in the future.

According to a study by Fidelity Investments, people who start saving for retirement at 30 are likely to have more than four times the amount saved by the time they turn 65 compared to those who start saving at 40. This proves that starting early gives your money more time to grow and compound.

To help you plan for retirement, we will introduce three investment strategies suitable for those starting to invest at 30, with detailed, actionable steps that will guide you on how to steadily grow your retirement savings and achieve desired returns.

1. Open and Optimize Your 401(k) Plan

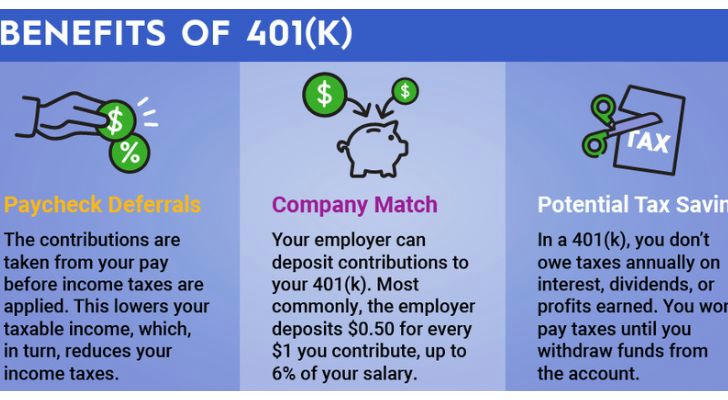

If your company offers a 401(k) plan and provides employer matching contributions, make sure not to miss out. A 401(k) is a tax-advantaged retirement savings account in the U.S. that allows you to contribute a portion of your income to the account, with investment returns being tax-deferred until you withdraw them. For someone around 30, this is a long-term and stable retirement savings tool.

Step 1: Start Contributing to Your 401(k)

Begin by contributing at least enough to take full advantage of any employer matching contributions. If your employer offers 50% matching on the first 6% you contribute, make sure to contribute at least 6% of your salary to get the full match. According to Vanguard’s 2024 Retirement Savings report, the average employer match is about 4.6% of an employee’s salary, which could significantly increase your retirement savings.

Step 2: Choose Low-Cost Investment Options

Within your 401(k), make sure to choose low-cost index funds that track broad market indices like the S&P 500. These funds tend to have lower fees and provide a reliable market return over time. According to Morningstar, low-cost funds can save investors thousands of dollars over a lifetime compared to high-fee funds.

Step 3: Increase Contributions Over Time

As your salary increases, aim to increase your contribution rate gradually. Ideally, try to increase your contribution by 1% each year until you’re contributing at least 15% of your salary. ***Charles Schwab ***suggests that increasing your savings rate can make a significant difference: “If you save 15% of your salary consistently, you are more likely to meet your retirement goals without needing to rely on high-risk investments.”

Experts suggest that by starting early and consistently contributing to your 401(k), you can take full advantage of tax-deferred growth, and with employer matches, you’ll build a large nest egg over time.

2. Open a Roth IRA Account and Enjoy Tax-Free Gains

A Roth IRA (Individual Retirement Account) allows you to invest with funds that have already been taxed, but **the investment returns and future withdrawals are tax-free. **It’s an ideal supplement to your 401(k) and provides more flexibility in terms of investment options.

Step 1: Check Eligibility and Open Your Roth IRA

The first step is to ensure that you meet the eligibility requirements. For 2025, if you’re a single filer, your income must be below $153,000 to contribute to a Roth IRA. If you meet the criteria, you can open a Roth IRA through a financial institution like Vanguard, Fidelity, or Charles Schwab.

Step 2: Contribute Regularly

Aim to contribute the maximum allowed each year, which in 2025 is $6,500 if you’re under 50. This may seem like a lot, but setting up automatic monthly contributions of $500 can make this goal more achievable. According to Investopedia, starting a Roth IRA at age 30 with consistent contributions can grow to nearly $1 million by the time you’re 65, assuming a 7% annual return.

Step 3: Invest in a Diversified Portfolio

Inside your Roth IRA, consider investing in a diversified mix of **low-cost index funds, ETFs, **and high-quality individual stocks. You may choose to focus on a broad-based stock market index fund (such as the S&P 500) or opt for a target-date retirement fund, which automatically adjusts its asset allocation as you approach retirement. BlackRock, a global investment management firm, states that “a diversified portfolio is essential for balancing risk and achieving steady growth.”

Step 4: Keep Track of Your Contributions

Roth IRAs have contribution limits, so make sure you track how much you’ve contributed each year. Any excess contributions can result in penalties, so it’s important to stay within the legal limits.

By maximizing your Roth IRA contributions from the start, you can enjoy tax-free withdrawals in retirement, giving you greater flexibility and security in your later years.

3. Diversified Investment Portfolio to Reduce Risk and Achieve Growth

Building a diversified investment portfolio is essential for reducing risk and ensuring consistent growth of your retirement savings. Diversification means spreading your investments across different asset classes (stocks, bonds, real estate) to avoid large losses in a single sector.

Step 1: Allocate Funds Across Asset Classes

For someone in their 30s, you should be able to take on more risk. A typical allocation could be 80% stocks (to maximize growth potential) and 20% bonds (for stability). Fidelity recommends that younger investors lean towards stocks for long-term growth but gradually shift to bonds as they approach retirement.

Step 2: Choose Low-Cost Funds

Opt for low-fee index fundsand ETFs that track large indices such as the S&P 500, which has historically provided solid long-term returns. Morningstar data shows that an S&P 500 Index Fund has returned an average annual rate of about 8% to 10% over the past 30 years, making it an attractive option for long-term investors.

Step 3: Consider Real Estate Investment

If you’re interested in adding real estate to your portfolio but don’t want to directly buy property, consider REITs (Real Estate Investment Trusts). These funds allow you to invest in real estate projects like commercial buildings and apartments, providing income through dividends and potential appreciation. According to NAREIT (National Association of Real Estate Investment Trusts), REITs have provided an average annual return of 9.7% over the last 20 years, making them a reliable option for diversification.

Step 4: Rebalance Your Portfolio

Over time, some investments will grow faster than others, potentially skewing your original asset allocation. To keep your portfolio aligned with your risk tolerance and retirement goals, rebalance it once or twice a year. According to Nobel Laureate Harry Markowitz ,“Diversification is the only free lunch in investing,” meaning it’s a key strategy for reducing risk.

By maintaining a diversified portfolio and regularly rebalancing it, you can achieve steady growth while minimizing risk, ensuring your retirement savings are working effectively for you.

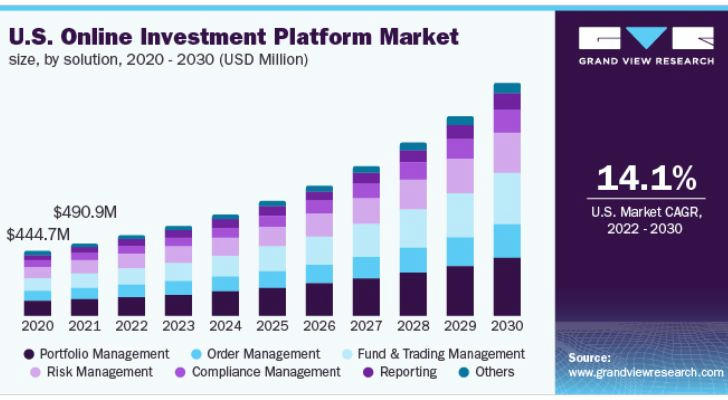

How to Keep Track of Market Trends and Ensure Steady Retirement Growth?

To ensure your investment portfolio stays on track, it’s essential to regularly follow market trends and adjust your investment strategy. You can rely on financial news websites like Yahoo Finance, MarketWatch, and others for real-time market data and economic insights. According to financial planning experts, periodically reviewing your portfolio will help ensure it aligns with your long-term retirement goals and risk tolerance.

Set up alerts for key market events, such as interest rate changes or significant shifts in stock market indices. These alerts will help you decide when it’s time to adjust your strategy or shift your asset allocation.

By utilizing financial tools and retirement accounts like 401(k)s, Roth IRAs, and diversified portfolios, and following these step-by-step strategies, starting at age 30 will help set you up for a strong retirement savings foundation. The earlier you start, the more you can benefit from the power of compound interest. Whether through 401(k), Roth IRA, or diversified investments, each step you take will help you build a more secure and financially independent retirement.