A Step by Step Guide to Unlocking the Best Private Health Insurance for Seniors

In today’s world, government health insurance often falls short, especially for seniors with limited financial resources. Private health insurance offers broader coverage and faster reimbursements, but choosing the right plan can be overwhelming. Don’t worry—this guide will walk you through the process of finding high-quality private health insurance with wide disease coverage and fast medical reimbursements.

Why Do Seniors Need Private Health Insurance?

The Role of Private Health Insurance

It provides a wide range of medical services to meet frequent health needs.

It reduces high medical costs caused by illnesses or accidents.

Limitations of Public Healthcare

Long waiting times: Surgery and specialist treatments in the public system can take months.

Limited coverage: Public insurance often excludes dental, vision, hearing care, and some advanced treatments.

Long-term care needs: Services like nursing home care and home assistance are usually not covered.

Reduce financial burden on children: Seniors often prefer not to rely on their children for medical expenses.

Key Data:

Chronic disease prevalence: Over 80% of people aged 65+ have at least one chronic disease (National Council on Aging).

Medical expenses: The average annual medical cost for seniors in the U.S. is $12,000 (Kaiser Family Foundation).

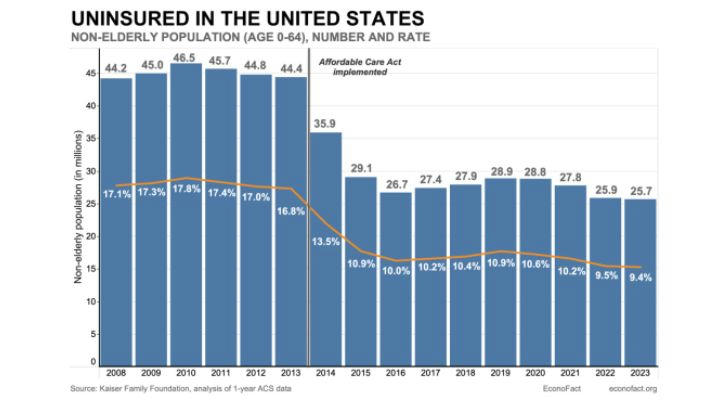

Private insurance growth: Private insurance coverage for seniors increased by 12% between 2015 and 2023 (U.S. Census Bureau).

Elderly population growth: By 2050, seniors will make up 16% of the global population (World Health Organization).

Public insurance insufficiency: Over 35% of American seniors use private insurance as a supplement (U.S. Department of Health & Human Services).

Advantages of Private Health Insurance Over Government Plans

Shorter Waiting Times

Public insurance often involves long waits for non-urgent surgeries and specialist treatments.

Private insurance offers faster appointments, access to specialists, and quicker surgical treatments.

Broader Coverage

Public insurance usually covers only basic services, excluding dental, vision, mental health, and advanced treatments.

Private insurance includes these additional services and preventive care.

Flexible Payment and Reimbursement Options

Private plans provide more options for reimbursement and coverage flexibility.

Some plans allow you to customize premiums and deductibles based on your budget.

Popular Health Insurance Options for Seniors

Here is a comparison of some well-known plans for older adults:

| Health Insurance Option | Overview | Benefits | Best Suited For | | :--- | :----: | ---: | | Medicare Part A | Covers hospital care, skilled nursing, hospice, and some home health. | No premium if taxes were paid; basic coverage. | Most seniors eligible for Medicare. | | Medicare Part B | Covers outpatient care, doctor visits, and preventive services. | Essential for managing health and regular checkups. | Seniors over 65 needing outpatient services. | | Medicare Part C (Advantage) | Combines Parts A, B, and often prescription, dental, and vision care. | Comprehensive coverage, including wellness programs. | Seniors seeking more services in one plan. | | Medicare Part D | Covers prescription medications. | Reduces costs of necessary medications. | Seniors who need regular prescription drugs. | | Medigap | Covers copayments, deductibles, and coinsurance not covered by Medicare. | Lowers out-of-pocket costs. | Seniors with original Medicare needing extra coverage. | | Long-Term Care Insurance | Covers nursing home care, home care, and assisted living. | Reduces costs of long-term care. | Seniors needing or anticipating long-term care. | | Individual Health Insurance | Private plans covering a range of services. | Flexible and customizable. | Seniors under 65 or ineligible for Medicare. | | Health Savings Account (HSA) | Combines high-deductible plans with tax-advantaged savings. | Lower premiums, tax-free savings for medical needs. | Younger seniors with fewer health needs. |

FAQs About Buying Private Health Insurance for Seniors

1. Why do seniors need private health insurance?

It provides access to a wider range of services and quicker treatments.

You can choose your preferred doctors and hospitals.

2. Which type of insurance should I choose?

Choose plans covering comprehensive services or specific needs like major illnesses or hospitalization.

3. How are premiums calculated?

Costs increase with age.

Pre-existing conditions may affect premiums.

Comprehensive plans cost more but offer better coverage.

How to Purchase Private Health Insurance

| Step | Key Points | | :--- | :----: | ---: | | Determine Eligibility | Check if you qualify for Medicare or private plans. | | Assess Needs | Identify your health priorities, budget, and desired benefits. | | Compare Plans | Use tools like Medicare Plan Finder or consult third-party agents for recommendations. | | Check Coverage | Ensure network doctors, hospitals, and medication lists meet your needs. | | Follow Enrollment Schedules | Adhere to Initial Enrollment Period (IEP), Annual Enrollment Period (AEP), or Special Enrollment Period (SEP). | | Submit Application | Complete applications online, by phone, or in person. | | Confirm Coverage | Verify the effective date and understand the policy’s terms. |

Pro Tip: Visit trusted resources like Medicare.gov, AARP Health, and eHealthInsurance for further details and comparisons.

Final Thoughts

Private health insurance for seniors provides essential benefits such as faster care, wider coverage, and financial security. By understanding your needs, comparing plans, and following a structured process, you can find the best insurance to support your health and lifestyle. Take control of your healthcare—your peace of mind is worth it!